Hidden Equity: What You Need to Know

Contact

Öffnungszeiten:

Monday to Friday

08.00 - 12.00 h / 13.00 - 17.00 hFernsupport durch Caminada:

Shareholders are permitted to grant loans to their corporations. Such passive shareholder loans are common among small and medium-sized enterprises (SMEs) and are often used to bridge short-term liquidity shortages. A passive shareholder loan represents a liability of the company to the shareholder. Passive shareholder loans require special attention, as they may, under certain conditions, be classified as equity for tax purposes. In this article, we will outline the specifics of so-called hidden equity.

Hidden equity refers to debt that is recorded as a liability under commercial law but is classified as equity for tax purposes. Instead of injecting equity, shareholders often provide debt capital to their companies in the form of loans. The primary rationale behind this practice is tax optimization. Interest on debt can be claimed as an expense, thereby reducing the taxable profit of the company. Additionally, unlike equity, debt capital is not subject to corporate capital taxation.

Debt provided by shareholders (or their related parties) may be classified as hidden equity. In contrast, debt provided by third parties (e.g., bank loans) never results in hidden equity.

For tax purposes, the loan-to-value ratios specified by the Swiss Federal Tax Administration (ESTV) must be adhered to. In Circular Letter 6a, the ESTV outlines the allowable levels of debt financing based on the composition of a company's assets. Generally, the market value of the assets is used to calculate hidden equity. However, an initial calculation is often performed using book values due to their easier accessibility.

| Asset | Max. Debt Financing (%) |

|---|---|

| Cash | 100% |

| Receivables | 85% |

| Inventory | 85% |

| Real Estate | 70-80% |

| Equity Investments | 70% |

Müller AG, based in Canton Z, is a mechanical engineering company that is in a tight financial situation. Shareholders A, B and C provide the company with debt capital to bridge the gap.

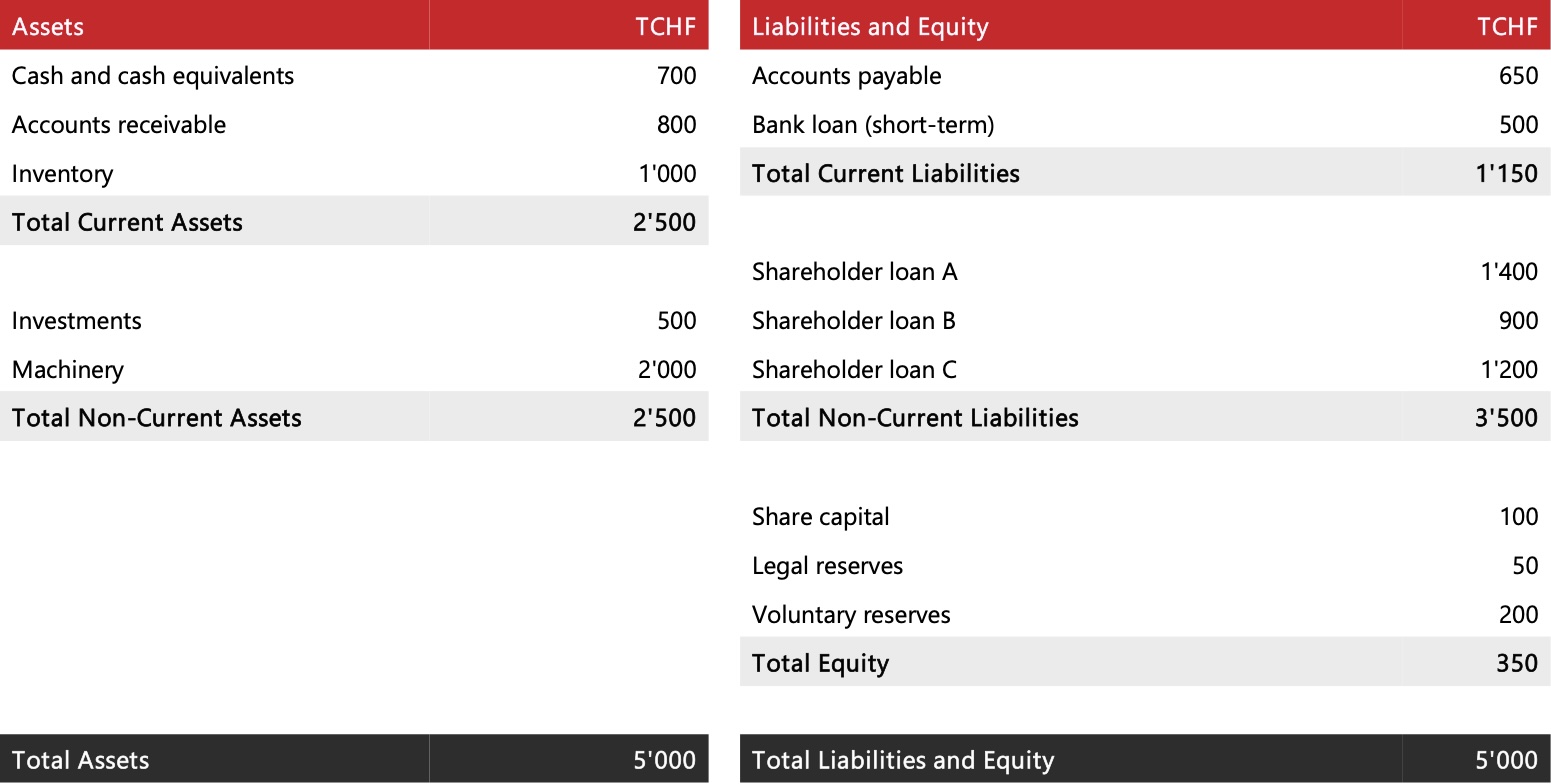

The balance sheet looks as follow:

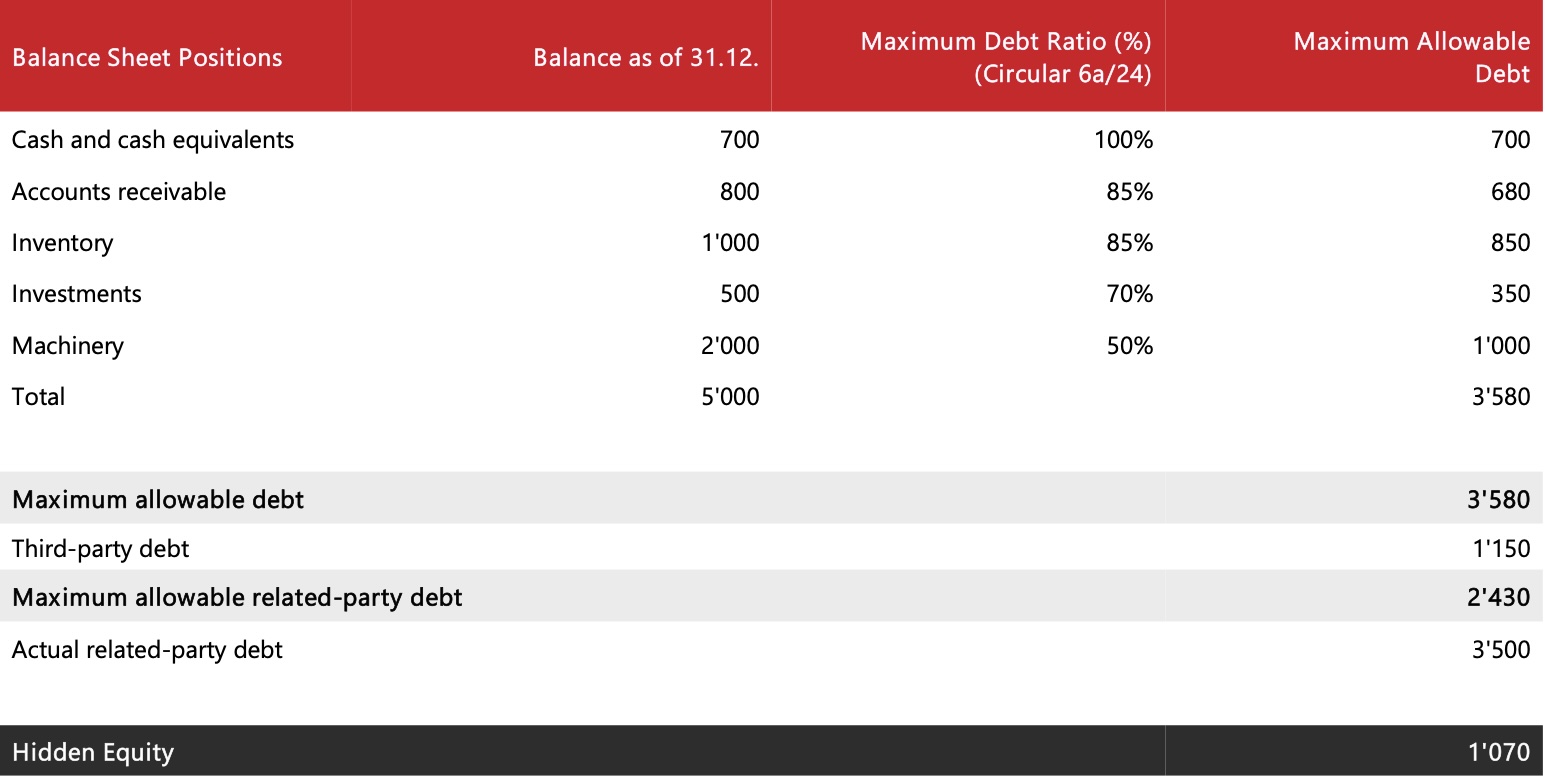

Whether hidden equity exists is determined based on the following ratios in accordance with Circular 6a. Depending on the type of asset, different debt financing percentages apply. The maximum allowable third-party debt is then calculated as the sum of the weighted assets.

In the present example, the maximum allowable amount of debt is CHF 3'580'000. After deducting third-party debt of CHF 1'150'000, a potentially allowable related-party debt of CHF 2'430'000 remains.

Since the existing shareholder loans total CHF 3'500'000, the difference between the maximum allowable related-party debt (CHF 2'430'000) and the actual related-party debt (CHF 3'500'000) results in hidden equity of CHF 1'070'000.

Hidden equity has tax implications for both the company and the lender.

Hidden equity is added to the company’s capital and is thus subject to capital tax. In this case, the taxable equity increases by CHF 1'070'000.

Interest on hidden equity is added back to the taxable profit.

Interest on hidden equity is considered a constructive dividend and thus subject to withholding tax.

The interest payments received by the lender on hidden equity are treated as profit distributions. As a result, they must be taxed as dividend income. This is generally not a disadvantage for the shareholder, as interest income is also subject to taxation. If the shareholder holds at least 10% of the company, this requalification is even advantageous due to the partial taxation of dividends.

The repayment of hidden equity is not considered a constructive dividend and is therefore not subject to withholding or income tax.

Shareholder loans are a common source of financing in Switzerland but carry tax and legal risks that are often underestimated. Particularly passive loans can become problematic if they do not comply with legal regulations and are treated as hidden equity. Lenders must also bear the same risks as equity holders, especially in cases of financial difficulty. Therefore, accurate calculation and proper handling of these loans are essential to avoid tax and legal pitfalls and ensure compliance with all regulations.

Are you facing the decision of how to financially structure your business? Do not hesitate to contact us! We can help you minimize legal and tax risks.